- The Portfolio Analytics service integrates automated independent e-valuation reports into the Debitos marketplace

- Interactive descriptive analytics reports , support improved analytical review and cash flow forecasts, enriching due diligence and transaction efficiency

- New Data Converter service transfers legacy data into soon-to-be mandatory EBA data templates, deepening industry-wide data standardisation

Frankfurt – April 17th 2023: Debitos, the leading marketplace for loan transactions in Europe, has integrated a Portfolio Analytics service into the platform, automating a primary due diligence function and support more efficient transactional activity.

The new Portfolio Analytics service enables buyers to build interactive descriptive analytics reports for transactions on Debitos. The dashboard supports cash flow review at portfolio and loan by loan levels, as well as a variety of due diligence enhancements which lead to informed investor decisions and expectations regarding purchase price, recoveries, asset distribution, collateral composition, legal actions and interest debt coverage ratios. This enhanced due diligence experience often result to more fine tuned pricing, aligning seller and buyer expectations.

“Loans often come to market for sale with the datatape consisting of custom Excel data templates, requiring time and skill to review, understand and valuate independently,, which ultimately incurs costs,” explains Timur Peters, founder and CEO of Debitos. “Our integrated Portfolio Analytics service is the latest addition to our suite of tools, designed to enhance transaction data with interactive analytical reports, aligned to industry best practice guidelines. Ultimately, standardised, simplified, and automated tools all help to support transactional activity and drive efficient pricing.”

The European Commission and the European Banking Authority (EBA) made this development possible by fostering Secondary Market activities around regulation and standardization. The EBA’s non-performing loan (NPL) data templates, created in 2017 and updated in 2018 and 2022, were designed to facilitate financial due diligence and the valuation of NPL transactions. The EBA’s non-performing loan (NPL) data templates are part of implementing technical standards (ITS) for the Credit Servicer Directive which will become a mandatory requirement for all transactions relating to credits issued on or after 1 July 2018 that became non-performing after 28 December 2021.

Data Converter service

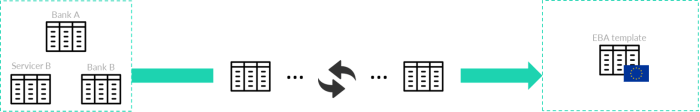

To support industry-wide adoption of the soon-to-be mandatory EBA NPL data templates, Debitos has developed a Data Converter service which transfers existing data from legacy bank-specific Loan Data Templates (LDTs) to standardised EBA templates. “The more the market moves towards standardised data templates, the more powerful the subsequent analytics become,” Timur Peters added, “standardised data fosters increased data collection, comparison and evaluation for assets and transactions which ultimately facilitates strategic decisions.”

Peters added: “Regular valuation data points, together with increased data standardisation, will further enrich asset and transaction analytics, providing ongoing actual portfolio performance over time. Together, these tools have the potential to expand the community of the Debitos marketplace by attracting more vendors to upload portfolios and through increased buyer engagement.”

These tools follow two major service additions to the Debitos platform last year. Last September Debitos launched the Servicing Navigator, which connects debt investors and banks with loan servicers, helping counterparties find the most appropriate servicers for their specific credit portfolios. Separately, Debitos launched the Creditor Coordination service which connects disparate creditors in, widely-held, corporate loan facilities in order to coordinate cooperation and transactions. All these services are part of the new premium Plan launched on the 6th of April 2023.

About Debitos

Debitos is the leading loan transaction platform in Europe that enables banks, funds and companies to sell their credit exposures on the market through its open and transparent auction-based online transaction platform.

The platform leverages on the digitalization of the entire sale process and can reduce the expected disposal timing to 3-8 weeks compared to 3-6 months of the traditional process. Debitos was founded in Frankfurt in 2010 and has since successfully transacted more than 800,000 loans in 16 countries. By now, more than 1,800 investors from all over Europe have registered with Debitos.

Read the orginal article: https://www.debitos.com/news/debitos-launches-data-converter-and-portfolio-analytics-services-in-support-of-the-ebas-standardization-process/