Kaleyra spa, an Italian group specialized in the global supply of mobile messaging services for banks and companies of all sizes, will be listed on the NYSE, thanks to the business combination with the US-based Special Purpose Acquisition Company (SPAC) GigCapital, specialized in the Technology, Media and Telecom sector, already listed at the NYSE (see here the press release).

Kaleyra spa, an Italian group specialized in the global supply of mobile messaging services for banks and companies of all sizes, will be listed on the NYSE, thanks to the business combination with the US-based Special Purpose Acquisition Company (SPAC) GigCapital, specialized in the Technology, Media and Telecom sector, already listed at the NYSE (see here the press release).

Kaleyra was born about a year ago after that the Italian company Ubiquity had acquired the Indian operator Solutions Infini. The new reality thus recorded a pro-forma turnover of about 65 million euros. But the shopping did not stop there. In August 2018 Kaleyra bought Hook Mobile, a US company specializing in the mobile services sector for companies and owner of an innovative cloud platform, thus bringing the pro-forma turnover to around 107 million dollars, with a team of over 200 people, distributed in 12 locations worldwide. The business combination with GigCapital aims now to support both organic and strategic growth of Kaleyra, especially in the US market.

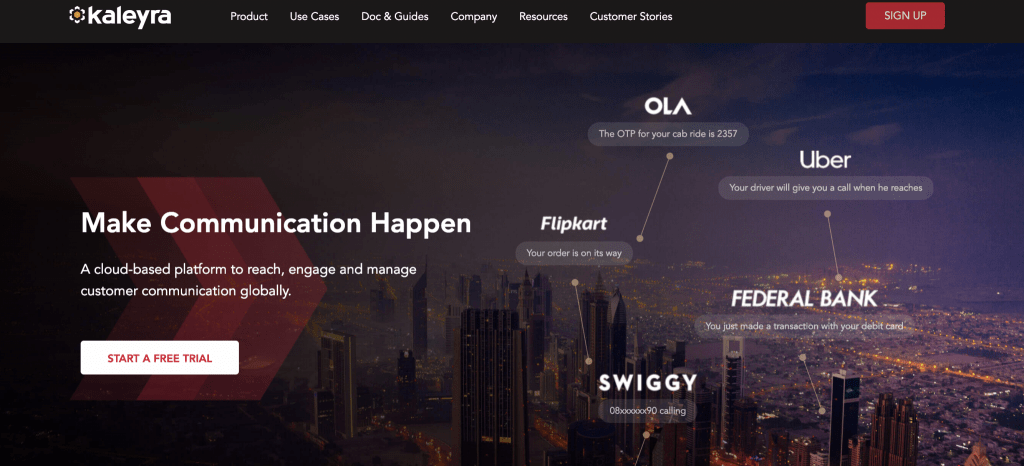

Led by ceo Dario Calogero, Kaleyra manages a multi-channel integrated communication service through the use of messages, push notifications, e-mail, instant messaging, voice services and chatbot. For the purposes of the business combination, the company has been valued 192 million euros or 1.5 x the expected revenues for 2019 and, after the transaction, the current shareholders of Kaleyra will hold a 33% stake, while the rest of the capital will be held by the current shareholders of GigCapital, chaired by Avi Katz. GigCapital, which was promoted by GigAcquisitions and Cowen Investments, was listed on the NYSE in October 2017 after having raised 150 million dollars from investors (see the SEC file here).

Cowen and Company supported GigCapital in the transaction as a financial advisor, while Crowell & Moring was the legal counsel. Kaleyra was supported by Northland Capital Markets and GCA Altium as financial advisors, while Cooley and Chiomenti were legal advisors.