Atlante fund will buy 92% of Banca Popolare di Vicenza capital in its first deal since the Italian Government sponsored veichle was launched for saving Italy’s distressed banks (see here a previous post by BeBeez). The announcement followed the official presentation of the fund last Friday April 29th by Quaestio Capital management sgr (download here the presentation).

Atlante fund will buy 92% of Banca Popolare di Vicenza capital in its first deal since the Italian Government sponsored veichle was launched for saving Italy’s distressed banks (see here a previous post by BeBeez). The announcement followed the official presentation of the fund last Friday April 29th by Quaestio Capital management sgr (download here the presentation).

The fund raised 4.25 billion euros from 67 Italian and international counterparts with banks, banking foundations, insurance companies and Cassa Depositi e Prestiti among them. The fund might be reopened inthe future as investors wil vote so with a 66.6% majority.

Alessandro Penati and Paolo Petrignani, Quaestio Capital Management sgr’s chairman and ceo respectively, explained that Atlante fund will have a 5 yeras long life plus 3 more years, an 18 months investment period (extendible for 6 months more) and no operative leverage (just a 10% leverage for temporary liquidity needs). Quaestio will ask for a 0.07% annual management fee.

As already announced, the fund will invest 70% of its committements capital increases of distressed italian banks as a back-stop facility. In this context is to be seen Atlalnte’s first deal on Popolare di Vicenza bank (download here the press release). Last Friday April 29th the capital increase of the bank closed with just 7.66% of the global offer covered at the price of 0.10 euro per share by investors for a total consideration of less than 115 million euro. So Atlante fund will subscribe “all the unsubscribed shares under the global offering, i.e. 13,850,514,380 shares at the offer price of euro 0.10 per share, for a total amount of euro 1,385,051,438 (accounting for 92.34% of the global offering)”,which means a 91.72% stake in the share capital of the bank.

All that, the bank’s press release says, is under condition that Borsa Italiana gives “authorization for the commencement of trading of the bank’s shares, upon verification that the free float of the bank after the global offering is adequate.(…) Whereas, should Borsa Italiana not issue the above authorization,the subscription requests submitted under the Global Offering will lapse and (…) the Atlante Fund will underwrite 15,000,000,000 shares at the offer price of euro 0.10 per share, amounting to euro 1,500,000,000 (100% of the Global Offering). In this event the Atlante Fund would hold a shareholding of 99.33% in the share capital of the bank”.

Coming back to the fund presentation, Mr. Penati and Mr. Petrignani added that it will invest at least a 30% stake of its committements in non-performing loans on the books of the Italian banks subscribing equity tranches of Npls securitizations. But not only.

The news is that the fund will be entitled to invest also in spv and funds of Npls and in “securities, real estate or other rights (even if they are not collateral for Npls) in deals aimed at recovering Npls value”. So MF Milano Finanza asked if this mean that Atlante fund might inject also new finance in the equity of companies whose loans are classified as Npls in order to relaunce their business and make the Npls value to recover. The answer was yes. Actually Mr. Petrignani said: “The fund rules have been left purposely vague in order to leave the fund free to act as it thinks is better”.

Mr. Penati went over and added that the Atlante fund might promote a consolidation process in the Italian servicer sector with the aim to create an independent subject of the right size able to support Italian banks in the reorganization of their Npls portofolios before the sale. Actually one of the reasons of a wide pricing gap between sellers an buyers of Npls in Italy is the lack of data transaprency in the Npls portfolios.

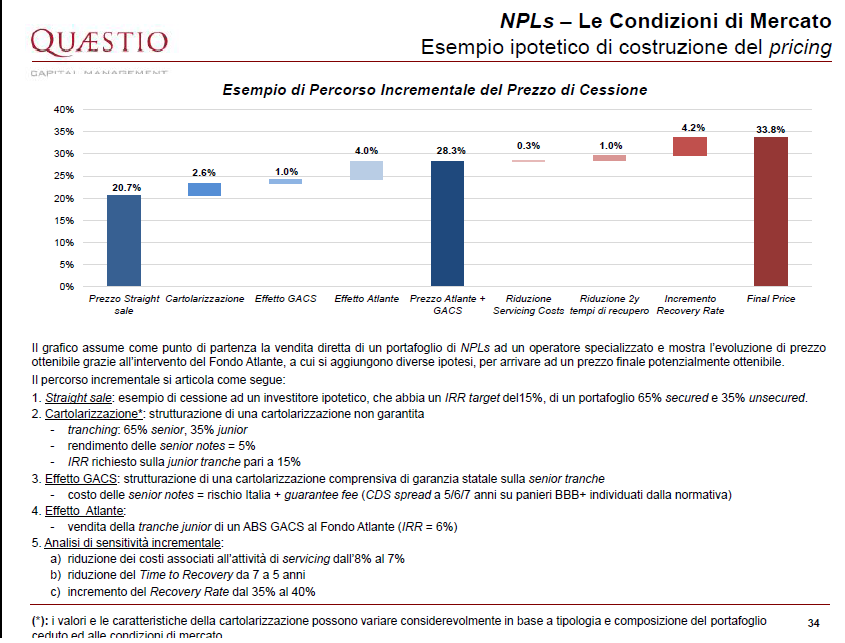

As for the acquiring priice, Mr. Penati stressed that “It’s not true that the fund will buy Npls at book value. It cannot be like that as the fund must gain a yield for its investors. Anyway it is true that we are not going to buy at the same high price the international investors have been buying Italian Npls till now”.

This come from mathematics as Atlante’s managers confirmed that the fund has a 6% gross yield target for its investors (see here a previous post by BeBeez), which is the same yield that an high yield in euros with a single B rating pays to investors while triple C high yield bond pay a yield which is in line with the 16-18% gross yield (or 12% net of management fees) paid by international funds focus on distressed assets. Using a lower yield as a discount factor in the calculation of the present value of Npls portfolios will help Atlante fund to pay less for those portfolios than its international competitors.

As for the dry powder the fund will have for Npls, Mr. penati and Mr. petrignani explained that the fund will invest all the remaining committements in Npls after June 30th 2017 which means that dry powder might be more than 30% of those committements depending on how many banks the fund will have saved then.

Moreover it is possible that some other subjects will co-invest together with Atlante in the equity tranches of Npls securitizations. or at least this is what Mr. Penati hopes. Which would result in a multiplier of Atlante’s dry powder (see here a previous post by BeBeez).