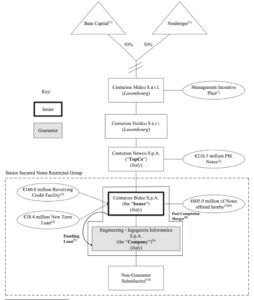

Italian IT company Engineering Ingegneria Informatica, a portfolio company of Bain Capital, NB Renaissance and NB Aurora, said it is going to issue a fixed rate senior secured bond of 385 million euros maturing in 2028 and with a rate of 11.125% (see here a previous post by BeBeez). The company will invest such proceeds in reapying a 385 million bridge loan that financed the public offer that Engineering launched on Milan-listed competitor Be Shaping the Future in December 2022 for an equity value of 441 million and an enterprise value of 483 million. The placement of the bond will end in mid-May (see here a previous post by BeBeez). The bond received a B2 rating from Moody’s and B- from S&P Global. Engineering has sales of 1.46 billion, an adjusted ebitda of 207.8 million and a net financial debt of 1.25 billion.

Rekeep (fka Manutencoop Facility Management), an Italian integrated facility management, received from SACE FCT and Banca Sistema a confirming line of 60 million euros for paying its suppliers and subsuppliers (see here a previous post by BeBeez). The fecility also received the warranty of SACE. Chiomenti assisted the lenders, while Rekeep appointed Latham & Watkins and Vitale & C. as advisors.

La Collina dei Ciliegi, an Italian wine producer that belongs to Massimo Gianolli (the founder and ceo of Milan-listed Generalfinance), received a 17 million euros financing facility from Intesa Sanpaolo, Banco BPM and Crédit Agricole Italia (see here a previous post by BeBeez). Grimaldi Alliance assisted the company while Studio Legale Guzzetti advised the lenders. The company will invest such proceeds in its expansion in the hotel and the acquisition of wineyards.

Fimer, an Italian producer of comonents for the photovoltaic panels, now belongs to Greybull Capital and UK automotive company McLaren who invested 50 million euros in financing and equity (see here a previous post by BeBeez). Fimer is in receivership. The buyers appointed board members Giovanni Varriale (chairman), Pierre Brochet and Luca Bertazzini.

Italian car rental firm Locauto received from UniCredit a 5-year financing facility of 10 million euros with the warranty of SACE for 80% of the amount (see here a previous post by BeBeez). The company will invest such proceeds in purchasing hybrid and electric vehicles. Raffaella Tavazza, second generation majority owner, heads the company. Further shareholders have 48% of Locauto.

Casalasco, an Italian food company of which QuattroR has 49% since 2021, received from Crédit Agricole Italia a 15 million euros financing facility with the warranty of SACE (see here a previous post by BeBeez). The company owns the brands De Rica and Pomì. Sources said to BeBeez that the company expects to generate sales of above 600 million that it will invest such proceeds in implementing CO2-reduction technologies.

Nefrocenter, an Italian provider of health care services, received from Banca Progetto an unsecured financing facility of 4.5 million euros for which Mediocredito Centrale provided a warranty (see here a previous post by BeBeez). The company will invest such proceeds in the acquisition of Rome American Hospital which retained Studio Legale Di Gravio e Associati as advisor. Francesco Fimmano, Consulting and Studio Associato Costanzo Ippolito Parenti assisted Nefrocenter which has sales of 1.7 million, an ebitda of minus 65281 euros, net cash of 89236, and equity of 0.178 million.

Adamas Biotech attracted a venture debt facility of 0.35 million euros from Banco BPM (60 months), 0.1 million from Milan-listed venture builder Cubelabs and 20000 euros from INBB (Istituto Nazionale Biostrutture e Biosistemi) (see here a previous post by BeBeez). MCC will provide a warranty for 80% of the amount. Saverio Bettuzzi founded Adams in 2018. The company will invest the raised proceeds in its organic development.

Clessidra Holding and Castello are competing for acquiring Italian UTP investor Value Italy (fka MPVenture) (see here a previous post by BeBeez). Value Italy has aum in the region of 400 million euros.

In 1Q23, UniCredit slowed down its derisking activity and posted NPEs of 12.6 billion euros (+0.4% from 3Q22 12.5 billion) (see here a previous post by BeBeez). Net NPEs amount to 6.5 billion.

In 1Q23, Intesa Sanpaolo NPEs amounted to 5.4 billion euros (down 2.1% – 5.5 billion in 4Q22) (see here a previous post by BeBeez). In 1Q22, the NPEs was of 6.8 billion.