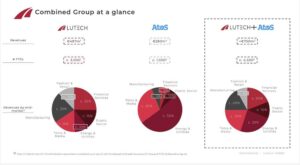

Lutech, an ICT company that Apax Partners acquired in March 2021 from One Equity Partners, announced the acquisition of Atos Italia from Paris-listed Atos International (see here a previous post by BeBeez). Lutech will rebrand the target as Lutech Advanced Solutions. Sources close to Atos International said to BeBeez that the asset’s enterprise value was 250 million euros. Such a sale is part of Atos’ 700 million divestitures programme. Lutech has sales of 437 million.

Worldline Merchant Services Italia, part of Paris-listed payment systems firm Worldline, signed an agreement to acquire Banco di Desio e della Brianza merchant acquiring unit (see here a previous post by BeBeez). The transaction is worth 100 million euros. Banco Desio retained Vitale & Co, Studio Legale Molinari Agostinelli and PriceWaterhouse Cooper as advisors.

Gruppo Lavazza acquired the majority of French online retailer MaxiCoffee from the founder Christophe Brancato, 21 Invest France (since 2011) and other minority shareholders (see here a previous post by BeBeez). Brancato will reinvest in the target for a minority and keep his chairman role. MaxiCoffee has sales of 300 million euros.

Milan-listed Eni is close to acquire the whole of Novamont of which it has already 36% through Versalis (see here a previous post by BeBeez). The Italian energy giant is in advanced talks with 64% owners NB Reinassance and Investitori Associati. Catia Bastioli is Novamont’s ceo. In 2022, Versalis raised its stake in the company from 25% to 36% for 141 million euros on the ground of an enterprise value of 1.4 billion.

Design Holding, a luxury furniture company of Carlyle and Investindustrial that is reportedly mulling for an IPO, generated 2022 revenues of 867.6 million euros (+15.7% yoy), an ebitda of 211.8 million (+24.4%), an ebit of 164.3 million, and cash of 153.5 million (see here a previous post by BeBeez). Previous press reports said that Design Holding aims to fetch 600 – 700 million for a publicly traded 30-35% on the ground of an enterprise value of 2 billion and that appointed as advisors BofA, UniCredit, Ubs, and JP Morgan.

CDPE Investimenti (part of CDP) invested 70 million euros for raising its stake in Italian industrial company Valvitalia from 50% to 75% (see here a previous post by BeBeez). The company will also restructure its banking debt and write off liabilities for 30 million. Salvatore Ruggeri (chairman), Massimiliano Ruggeri (executive vicechairman) and Luca Ruggeri (head of sales) will keep their roles. Andrea Forzi is the company’s ceo. Valvitalia previously attracted the interest of Finint.

Co-operative supermarket chain Conad Nord Ovest acquired from Bennet three shops based in the North-West of Italy (see here a previous post by BeBeez). The transaction is worth 4.4 million euros and is subject to the authorization of Italian Antitrust.

Wise Equity will list Italian shipyard Cantiere del Pardo as soon as financial markets are less volatile (see here a previous post by BeBeez). The fund acquired 60% of the asset in 2020 from Luigi Servidati and Fabio Planamente, that now keep 20% each. Cantiere del Pardo has sales of 71.4 million euros, an ebitda of 15.2 million, a net financial debt of 13.4 million, and equity of 31.6 million

Migal, an Italian producer of industrial components that belongs to Equinox (60%) and the Mingotti Family (40%), acquired Italian competitors Pressofusione Comero, Sveva Stampi from the Niboli Family and Coccoli from the eponymous family (see here a previous post by BeBeez). CP Advisors, KPMG and Studio Legale Pedersoli assisted Migal. The Niboli family retained Milan-based Andersen while the Coccoli Family hired Maruggi. Pressofusione Comero has sales of 15 million, an ebitda of 2 million and net cash of 2 million. Svea Stampi has revenues of 2.7 million and an ebitda of 0.23 million. Migal is interested in further acquisitions.

M-Cube digital engagement, an Italian instore marketing company that belongs to HLD Europe, acquired Notice Group, a Dutch competitor (see here a previous post by BeBeez). M-Cube financed the transaction with the proceeds of a 7.35 million euros bond that issued earlier this year.

Domus, a vehicle of Hines, Apollo Asset Management and VI-BA, will soon communicate the timing for the delisting of real estate firm Aedes SIIQ from Milan market (see here a previous post by BeBeez). Domus has 95% of the target.

Customs Support, a Dutch logistic company that belongs to Castik Capital, acquired Errek from the Curzel Family (see here a previous post by BeBeez). Customs Support retained as advisor Pavia e Ansaldo, Ploum, Armella & Associati, New Deal Advisors, and Equita K Finance. Errek appointed Studio Zumerle. The target has sales of 3.9 million euros, an ebitda of 1.8 million and net cash of 2.6 million.

Fondo AZ ELTIF Capital Solutions, a vehicle of Milan-listed Azimut that Muzinich & Co. manages, acquired a further 40% of Canepa, an Italian textile company, from Michele Canepa (see here a previous post by BeBeez). The fund purchased a 30% of the asset in November 2021. Invitalia has 30% of Canepa which has sales of 14 million euros, an ebitda of minus 8.5 million, equity of 9.7 million and debt of 23 million.

Snaitech, an Italian gambling company, acquired Gruppo Giove (see here a previous post by BeBeez). Agostino Romano, chief retail operations officer of Snaitech, will be the new ceo of the group. Snaitech has sales of 899.8 million euros and an ebitda of 254.2 million.

The Italian Ministry of Economics may sign an agreement with Lufthansa for the sale of Italian airline ITA Airways before 24 April, Monday (see here a previous post by BeBeez). The final price should be of 200 million euros. However, Lufthansa ceo Carsten Spohr said that the transaction value should reflect the fact that ITA generated losses of 486 million.

The Italian Ministry for business and Made in Italy put roubled Italian insurer Eurovita, a portfolio company of Cinven, in extraordinary administration (see here a previous post by BeBeez). Alessandro Santoliquido and Antonio Blandini are the company’s commissioner and chairman while IVASS, the Italian insurance authority, appointed Sandro Panizza and Monica Biccari as auditors.

San Quirico, the holding of the Garrone and Mondini Families, acquired 75% of MinervaHub, a producer of luxury fashion accessories, from Xenon Private Equity (see here a previous post by BeBeez). The target’s enterprise value amounts to 500 million euros. MinervaHub has sales of 180 million. an ebitda of 50 million, and a 15% net profit. The company attracted the interest of CVC Capital Partners, Carlyle, Investindustrial, and TowerBrook Capital Partners.

Ecomembrane, a gas stocking and renewable energy company, started the process for launching an IPO on Milan market in 1H23 (see here a previous post by BeBeez). The company will list through the launch of a capital increase for institutional investors. Ecomembrane appointed as advisors Private Equity Partners, Equita sim, Grimaldi Alliance, BDO Italia, Reply Consulting, and Spriano Communication. The company belongs to Lorenzo Spedini (founder and ceo – 80%) and Luigi Spedini (20%) and has sales of 14.2 million euros (11.7 million in 2021) and an ebitda of 3.3 million (2.4 milioni).

Industry 4.0 Fund sold EPI, an Italian vendor of football merchandising that acquired in November 2020, to Fanatics (see here a previous post by BeBeez). The vendor retained as advisor Studio Giliberti Triscornia e Associati and T8P Consulting.