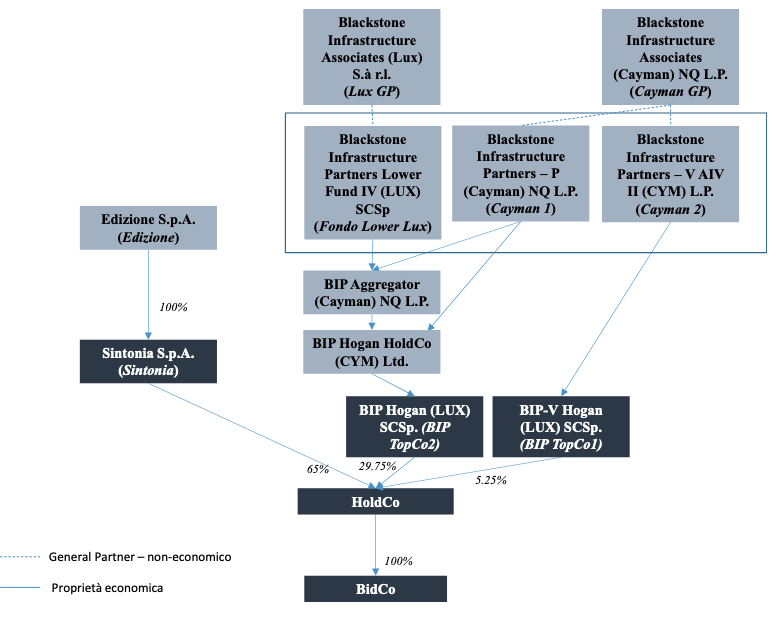

The public offer that Blackstone Infrastructure Partners and the Benetton family launched on Milan-listed Atlantia on 10 October, Monday, ended 11 November, Friday (see here a previous post by BeBeez). The bidders raised 54.249% of the company and now own a total of 87.350%. Blackstone and the Benetton family gave up the achievement of the threshold of 90% and extended from 21, Monday, to 25 November, Friday, the deadline to tender the offer of 23 euros per share for an equity value in the region of 19 billion euros.

The public offer that Blackstone Infrastructure Partners and the Benetton family launched on Milan-listed Atlantia on 10 October, Monday, ended 11 November, Friday (see here a previous post by BeBeez). The bidders raised 54.249% of the company and now own a total of 87.350%. Blackstone and the Benetton family gave up the achievement of the threshold of 90% and extended from 21, Monday, to 25 November, Friday, the deadline to tender the offer of 23 euros per share for an equity value in the region of 19 billion euros.

Intesa Sanpaolo started in the evening of November 14th an accelerated book building procedure for selling up to 5.1% of Milan-listed paytech Nexi (see here a previous post by BeBeez). IMI – Corporate & Investment Banking, BofA Securities and JPMorgan are acting as joint bookrunners. Intesa paid 653 million in 2020 for acquiring 9.9% of the paytech. The stake was finally sold at a price of 8.7 euro per share for a total of 584 million euro the bank said in a statement on November 15th.

There is also a major private equity and Italian implication behind the $2.8 billion deal announced by The Estée Lauder Companies (ELC), the cosmetics giant that owns iconic brands such as Clinique, La Mer, and Aveda, to acquire fashion brand Tom Ford, hitherto owned by the Texas-based designer of the same name (see here a previous post by BeBeez). Private equity, it was said, has a lot to do with this because the agreement with Estée Lauder in fact also provides for the extension of the licenses of Tom Ford’s current partners. In particular, licensing relationships will be extended with both Ermenegildo Zegna and Marcolin, in both cases Italian groups with private equity investors in their capital (although Zegna is listed). In detail, eyewear manufacturing group Marcolin, which was delisted from the Milan Stock Exchange in 2013 and has since been controlled by the PAI Partners fund, at the same time as the announcement of Tom Ford’s transition under ELC’s control, has negotiated a long-term licensing relationship with ELC itself for Tom Ford eyewear, which is a significant extension of the licensing agreement that has been in place until now. The new agreement will, in fact, secure a perpetual license against payment by Marcolin of $250 million to Tom Ford, which, upon payment, will have already become the property of ELC. To finance the deal, Marcolin will draw from its cash but also from new resources derived from a capital increase of at least 50 million euros, which will be underwritten by Marcolin’s shareholders and then by the PAI Partners fund. As for the Ermenegildo Zegna Group, listed on the NYSE from the end of 2021, participated in by Investindustrial, a private equity operator founded by Andrea Bonomi, and owner of the Zegna and Thom Browne brands, it will become ELC’s long-term licensee for all Tom Ford men’s and women’s fashion products, as well as accessories and underwear, jewelry, children’s wear, textiles, and home design products. Zegna’s licensing agreement with The Estée Lauder Companies runs for 20 years and provides for automatic renewal for another 10 years, subject to certain minimum performance conditions being met. As part of this transaction, Zegna will acquire Tom Ford’s fashion business necessary to fulfill its obligations as a licensee. The value of the transaction has not been disclosed at this time, but it has been clarified that Zegna will finance it with cash.

Italian mid-tier football team Udinese Calcio attracted the interest of NYSE Spac Group Nine Acquisition Corp (GNAC), a vehicle that raised 230 million US Dollars (see here a previous post by BeBeez). Udinese belongs to the Pozzo family since 1986 and its enterprise value amounts to 200 million. The team has sales of 107.8 million euros, an ebitda of 29.8 million, net losses of 36.9 million, and equity of 196.3 million

Antin Infrastructure Partners invested in HOFI (Holding Funeraria Italiana), an Italian funeral house that belongs to Augens Capital, BMO Global Asset Management, and the Cerato Brothers (see here a previous post by BeBeez). Antin Infrastructure Partners has resources of above 29 billion euros.

Peninsula Capital and the Percassi Group acquired 40% of Italian holidaywear MC2 Saint Barth (see here a previous post by BeBeez). Peninsula and Percassi will support the company in the expansion of a network of monobrand shops. Massimiliano Ferrari and Raffaele Noris, the founders of MC2 Saint Barth, will keep a 60%. MC2 Saint Barth has sales in the region of 80 million euros.

Fondo Agroalimentare Italiano, a vehicle that Unigrains launched, sold its 68% in Italian transport company Trasporti Romagna to Eurizon Iter Fund Eurizon Iter and Eurizon Iter Eltif, two funds of Eurizon Capital Real Asset that ITER Capital Partners manages (see here a previous post by BeBeez). BeBeez earlier reported about such negotiations. Banca Intesa and the ceo Simone Romagna, the minority shareholders of Trasporti Romagna, will reinvest in the company. Unigrains retained Gitti & Partners (legal) and Rothschild & Co (M&A advisor). Trasporti Romagna has sales in the region of 280 million euros.

Croci, an Italian producer of items for pets of which Mindful Capital partners owns 70% since December 2021, acquired Spanish competitor Creaciones Arppe which retained Highland Corporate as financial advisor(See here a previous post by BeBeez). Pavia e Ansaldo (legal) and KPMG (financial due diligence) assisted Croci which has sales of 50 million euros (50% export).

Ambienta sgr, one of Europe’s largest asset managers among those devoted entirely to environmental sustainability, has acquired a majority stake in German baby goods manufacturer Lässig from Arcus Capital and founders Claudia and Stefan Lässig and Karin Heinrich. Ambienta thus became the new majority shareholder alongside the founders, who retain a significant stake in the company (see here a previous post by BeBeez).

We.Do Advisory, a subsidiary of Italian IT company DGS, acquired the consultancy unit of Soft Strategy (see here a previous post by BeBeez). DGS belongs to Hig Capital since 2020. Soft Strategy belongs to Antonio Marchese and has sales in the region of 26.5 million euros.

Rototech, an Italian producer of rotational and blow molding items that belongs to Quadrivio Industry 4.0, acquired the majority of Brazilian Tecnotri Indústria de Plásticos from the founder and chairman Leonardo Segatt who will keep a minority (see here a previous post by BeBeez). The managers of Rototech will keep their roles. Tecnotri has sales of 5 million euros with an ebitda of 1.5 million (30% ebitda margin).

Metrika, the private equity that Marco Giuseppini and Nicola Pietralunga head, acquired the majority of Sefo, a producer of racing bikes aftermarket components with the brand CNC Racing, from the Fornaini and Secondini families who will keep a minority and the management roles (see here a previous post by BeBeez). Cassa Centrale Banca financed the transaction. Sefo aims to grow further through M&A. The company has sales of 5.6 million euros, an ebitda of 2.6 million and net cash of 2.6 million.

Bravo Capital Partners acquired Sipral Padana, a producer of food ingredients, with the management support of Gianpietro Corbari, the former coo of Italian dairy company Granarolo and ceo of supermarkets chain PAM (see here a previous post by BeBeez). The Patrini family sold the company. Corbari will act as chairman and ceo of Sipral, while Giovanni Paolo Tavazzi will be part of the management team. Banco BPM financed the transaction. Sipral has sales of 17.1 million euros, an ebitda of 1.5 million and net cash of 0.38 million. The company aims to grow through acquisitions.

VERTEQ Capital, the private equity that Ennio Valerio Boccardi heads, acquired the majority of Radici Products, a producer of industrial components, from Luca Calabria, Felice Danesi, Simona Glisenti, and Roberta De Vecchi (25% each) (see here a previous post by BeBeez). Calabria and Danesi reinvested for a minority of the business. Banco BPM financed the transaction and provided the company with a capex facility for add-on acquisitions. Radici Products has sales of 7.7 million euros, an ebitda of 1.4 million and net cash in the region of one million

FVS (a subsidiary of Veneto Sviluppo) and Clessidra Capital Credit created Candy Factory, an Italian sweets producer out of the merger of Casa del Dolce with Liking (see here a previous post by BeBeez). The Castellazzi family (Casa del Dolce) and Corno (Liking, a portfolio company of FVS since February) will retain a minority of Candy Factory of which the financial investors will keep the majority. Sources said to BeBeez that the transaction equity value amounts to 75 million euros. Cassa Centrale Banca – Credito Cooperativo Italiano financed the transaction and retained Shearman Sterling as legal advisor.

Italian luxury fashion platform Gruppo Florence acquired the majority of denim process company Ideal Blue Manifatture from the Moretti family (see here a previous post by BeBeez). Ideal Blue has sales of 30 million euros. With Ideal Blue Manifatture, the number of companies that have decided to join the industrial project of Gruppo Florence, controlled for about 65% by a consortium led by VAM Investments, Fondo Italiano d’Investimento (through Fondo Italiano Consolidamento e Crescita – FICC) and Italmobiliare, and for the remaining 35% by the founding families of the companies that are part of the group, has risen to 21. Florence Group, with the latest acquisition has exceeded 500 million euros in turnover and has more than 2,200 active employees in 12 regions, working with more than 50 international brands.

RedFish LongTerm Capital said it acquired a 20% of Italian manufacturer of steel chimney systems Expo Inox from the ceo Mauro Travini (see here a previous post by BeBeez). Norton Rose Fulbright (legal) and Kreston GV Italy Audit (m&a) assisted the vendor. Kayak carried on the due diligence. Expo Inox has sales of 70 million euros and an ebitda margin of 12%

Nextalia, an Italia private equity that Francesco Canzonieri created, will soon start to raise resources for another fund, said the founder (see here a previous post by BeBeez). Earlier in June, Nextalia raised 800 million euros for its debut fund, well above its 600 million target.

Waico, an Italian producer of machinery for the food industry said it acquired Italian competitor Italforni from Branislav Pagani (50%), Andrea, Raffaella and Roberto Ricci (5.56% each) and Anita Toffoli (33.33%) (see here a previous post by BeBeez). Andrea Ricci will reinvest for a minority while keeping his management role of Italforni which has sales of 9 million euros, an ebitda of 1.8 million and net cash of 2.9 million. Mindful Capital Partners created Waico in 2021 out of the merger of Vitella, Starmix and Effedue. The company has sales of 23 million (60% export) and an ebitda margin of 15%.

C2Mac Group (fka Fonderie di Montorso), an Italian industrial company, acquired Italian competitor Tecnomeccanica (see here a previous post by BeBeez). Fondo Italiano Consolidamento e Crescita (FICC), a fund that FII manages, acquired 70% of C2Mac from the Comello Family in 2018. After such an acquisition, the company has sales of 200 million euros.

Neulabs, the Italian platform for the development of Direct-To-Consumer brands that Mauro Giacobbe founded, acquired BabyCar, a distributor of toys (see here a previous post by BeBeez). After such an acquisition, Neulabs might generate sales of 35 million euros. Ciro Lillo and his son Rocco founded BabyCar in 2016. The company has sales of 5 million.

HIG Capital acquired a controlling stake of Onis Visa, an Italian producer of generator sets and motor pumps, from the Barro Family who will keep a minority and retain management roles (see here a previous post by BeBeez). Onis has sales of 115 million euros. Crédit Agricole FriulAdria, Deutsche Bank, MPS, and BPER financed the transaction. Equita Private Debt Fund subscribed a subordinated bond. Raffaele Legnani, the managing director of HIG in Italy, said that the company aims to grow through acquisitions.

Italian private equity 21 Invest, a fund that Alessandro Benetton heads, committed to acquire Trime, a producer of lighting towers, from Wise Equity which purchased 60% of the business in March 2019 (see here a previous post by BeBeez). Andrea Fontanella, chairman and founder, Paolo Tacconi, ceo, and the managers will reinvest for a minority of the company and keep their operative roles. Trime expects to generate sales of 90 million euros.

The Riverside Company said it acquired 67.32% of BioDue, an Italian producer of cosmetics, food integrators and medical devices, from Armònia which delisted the company from Milan market in 2019 (see here a previous post by BeBeez). Further shareholders of the target are Vanni Benedetti (16.75%), Pierluigi Guasti (12.53%) and Terastone (3.4%). Rothschild & Co assisted The Riverside Company, while BioDue hired as advisors Ethica Group (M&A), Gatti Pavesi Bianchi Ludovici (legal), Deloitte (financial due diligence), and Alonzo Committeri & Partners (fiscial due diligence). BioDue has sales of 75 million Euros.

Swegon Group, a Swedish company that belongs to Stockholm-listed Investment AB Latour, a vehicle that the Douglas Med Bolag family controls, acquired Samp, an Italian producer of items for air treatment, from Gianluigi Sala, Luigi Treccani, Ernesta Antonia Redaelli, and Maria Giulia Maccagni (see here a previous post by BeBeez). Swegon hired Chiomenti (legal), Studio Legale Tributario EY (tax) and EY Advisory (financial due diligence). Samp has sales of 25.6 million euros, an ebtida of 2.3 million and net cash of 0.58 million and retained PwC TLS as advisor.

Arcano Partners, a Spanish financial services firm, hired Marina Boccadifuoco as Business Development Director for its Milan bureau that Paule Ansoleaga Abascal heads (see here a previous post by BeBeez).