Itelyum, a group specialized in the management, recycling and valorisation of industrial waste, controlled by private equity firms Stirling Square Capital and participated by DBAG, priced at par a 450 million euro sustainability-linked bond with a 4.625% coupon and maturity October 2026 (see here the press release). The launch took place on 13 September (see the press release here).

The bond will be listed on the Luxembourg Stock Exchange and provides for precise conditions of use of the proceeds, as described by the Sustainability-linked Framework and as certified by the independent advisor ISS ESG in its Second Party Opinion.

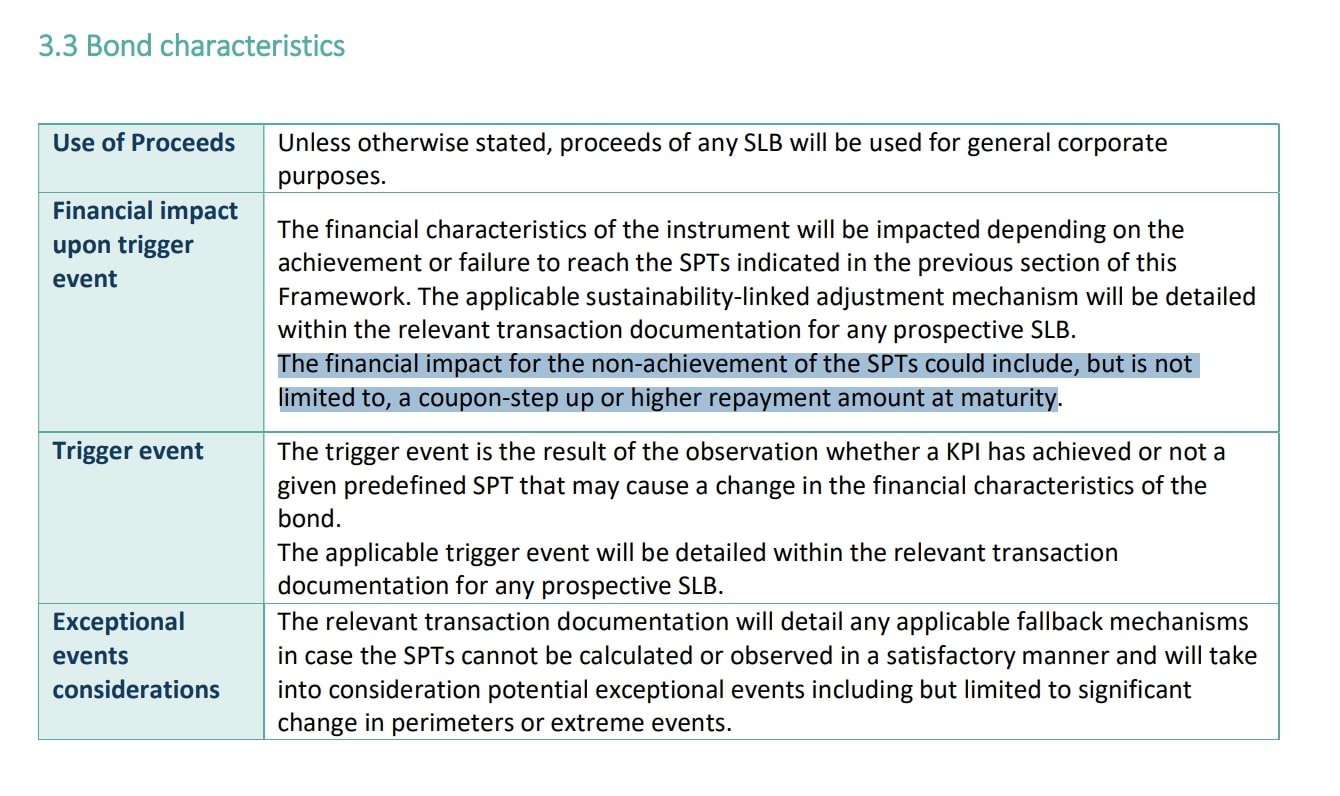

The framework explains that the financial characteristics of the instrument will depend on whether or not the indicated ESG objectives have been achieved and that the mechanism for applying any penalty in the event of non-achievement of the objectives will consist of an increase in the coupon or a higher repayment at maturity. And the latter solution, which is the one that was chosen, is a real novelty for this type of bonds, which usually only provide for the step-up of the coupon (see Global Capital here).

The bond is issued by Verde Bidco spa, the vehicle that controls Itelyum and which was used by Stirling Square to conduct the buyout on Itelyum last August, when Striling Square essentially resold the group to itself. The Stirling Square Fund III has in fact transferred control of the company to the Fund IV, keeping the majority of the group, with the new investor DBAG buying a minority of about 30% both directly and through the DBAG Fund VII fund. The management team also invested for a minority (see here a previous article by BeBeez).

We recall that Itelyum was born from the integration between Viscolube, a company based in Lodi (close to Milan) that is the first in Europe in the recycling of lubricants, and Bitolea, a company based in Pavia (again in Northern Italy, close to Milan) that is a continental leader in the purification of used solvents. Stirling Square had taken over the majority of Viscolube in December 2011 from the Rietschaar sa group and from Giorgio Carriero, who then kept a minority. Carriero had previously acquired its stake from the Milan-listed oil&energy giant ENI. As for Bitolea, in July 2017 it was sold by private equity asset manager Clessidra sgr to Viscolube (see here a previous article by BeBeez). In turn, Clessidra had bought a 80% stake in Bitolea in 2012 through its Fund II, while the Intini family had kept the remaining 20% of the capital. The family had then completely left the capital together with Clessidra when Viscolube had taken over the entire capital.

Italyum has then completed four acquisitions in the past two years. At the beginning of March 2020 it acquired 100% of the Idroclean Group, a reference company in Lombardy and Northern Italy for the treatment and purification of industrial water, and 80% of Carbonafta, an Umbrian company active in the management of industrial waste (see here a previous article by BeBeez). A few months later, in July, Itelyum acquired 100% of Intereco srl, a leading company in environmental services and partner of companies and public bodies, from entrepreneurs Tiziano Fontanesi and Mario Botti (see here a previous article by BeBeez). While at the beginning of last July, Itelyum took over the Apulian Castiglia (see the press release here), a historic company from Massafra (Taranto), which has been operating for 20 years in the sustainable management of sludge deriving from the treatment and purification of water and high added value services for large industry, including management and maintenance of water networks and aqueducts, demolition, reclamation, remediation and revamping of industrial plants and port environmental services.

Also considering the latest acquisition, Itelyum, based in Pieve Fissiraga (Lodi), today manages over one million tons of special waste, generating revenues for a total of 340 million euros in 2020, with 600 employees and 20 operating sites. According to BeBeez, in 2021 the Itelyum group aims to achieve a consolidated turnover of over 420 million euros with an ebitda of around 80 millions.