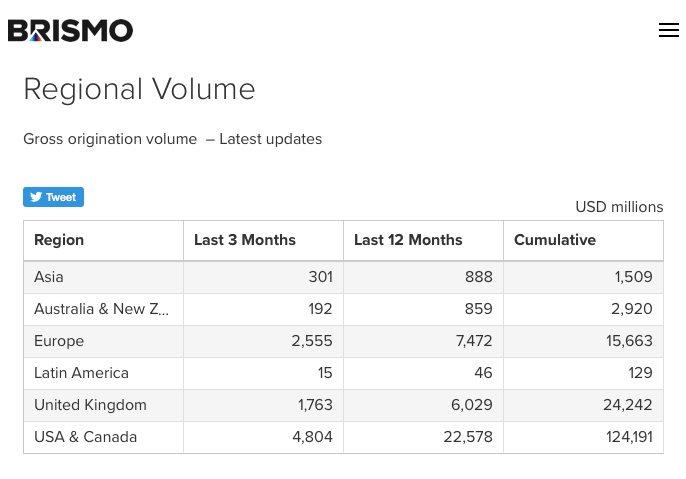

In 2019 and the last quarter of 2019, we saw a boom in crowdlending in continental Europe, with gross volumes of $7.5 billion and $2.56 billion respectively, for a cumulative total raised by the platforms since the start of their operations of $15.7 billion. This is said by Brismo. . .