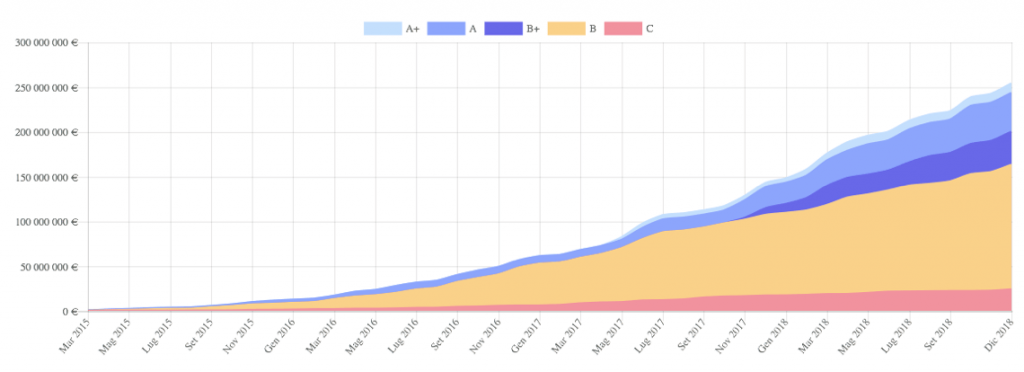

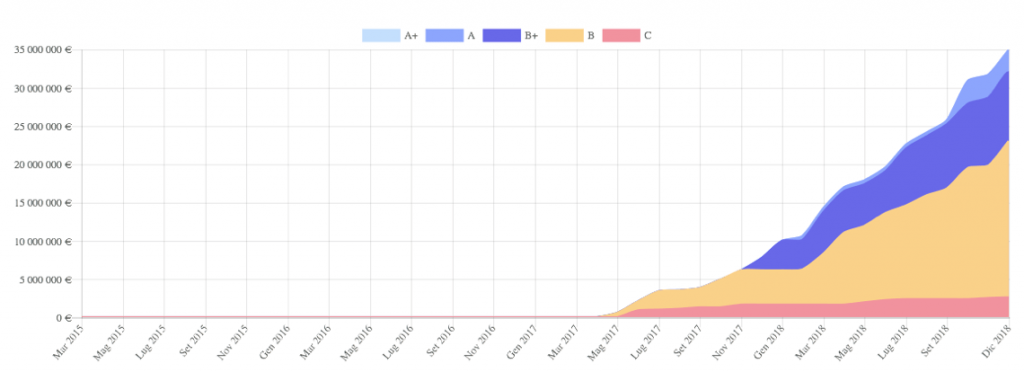

The European P2P lending platform October ended 2018 with 111.3 million euro granted to 190 companies, for a total of 230,852 loan contracts by private and institutional investors (see the press release here). Of this total, over 28 million have been disbursed to Italian companies (see the statistics here). Among the companies financed there are weel-known names as the builder of the Grand Soleil sailboats, Cantiere del Pardo, or the manufacturer of tomato sauce Petti. In 2017, on the other hand, the year when the platform opened shop in Italy, October had provided 7.7 million euros only.

October’s boom in Italy is part of a very effervescent market trend in the country. The latest statistics provided by P2P Lending Italy have in fact indicated a jump to 763 million euro of the total provision of the 10 monitored lending platforms (which however include lending platforms to individuals, lending to companies and invoice financing), with an increase in 125% compared to the 340 million provided by the same ten platforms in 2017.

Founded in 2014 by Oliver Goy, from the beginning of its activity (April 2015) to date, October has received and analyzed a total of 103,594 requests for financing, funded 549 projects and granted loans for 254.2 million euros. Of this total, from the Spring of 2017, 35.9 million euros were issued to 63 projects of Italian companies. Led in Italy by Sergio Zocchi, October had over 15 thousand investors active in the country in December 2018: 34% institutional, 33% family office, 19% private and 13% professional investors.

Simultaneously with the change of name from Lendix to October at the end of October 2018 (see here a previous post by BeBeez), the platform is also active in the Netherlands, which joins Italy, France and Spain, while by the end of this year the goal is to cover seven countries in Europe.

The territorial expansion was one of the first objectives quoted by October last June, when the last funding round of 32 million euro was announced. The round was led by Idinvest Partners, Allianz France and CIR spa (the listed holding company of the De Benedetti family), together with the historical investors of October, which are Partech Ventures, CNP Assurances, Matmut and Decaux Frères Investissement (see here a previous post by BeBeez).

Moreover, as it is known, 100% of the projects published on the platform are financed: at least half of the request is covered by the funds of October, which take over the difference, if the remaining half is not covered by private investors.

In January 2018 October announced the closing of the fundraising of its 200 million euros last fund, which was subscribed by Zencap Asset Management, Matmut Frères Investissements, Groupama, European Fund for Investments, Eiffel IM, Decaux Frères Investissements and CNP Assurances (see here a previous post by BeBeez). On arrival there is a new investment vehicle dedicated specifically to Italy, as BeBeez and Milano Finanza last November reported quoting Andrea Bianchi, general manager of ConfidiSystema !, which has already signed part of the shares dedicated to the Italian credit consortia (so-called Confidi, see here a previous post by BeBeez).

To encourage SMEs to use the lending platform, last October the platform launched the Crescere Insieme initiative, sponsored by the French Minister of Economy and Finance, Bruno Le Maire, with the support of eleven major French industrial and financial groups (AccorHotels, The Adecco Group, Allianz, Arkéa, Edenred, ENGIE, Iliad, JCDecaux, Suez, Unibail Rodamco Westfield and Webhelp), who have agreed each to ask for a symbolic loan of 100k euros on October to be financed only by private investors.