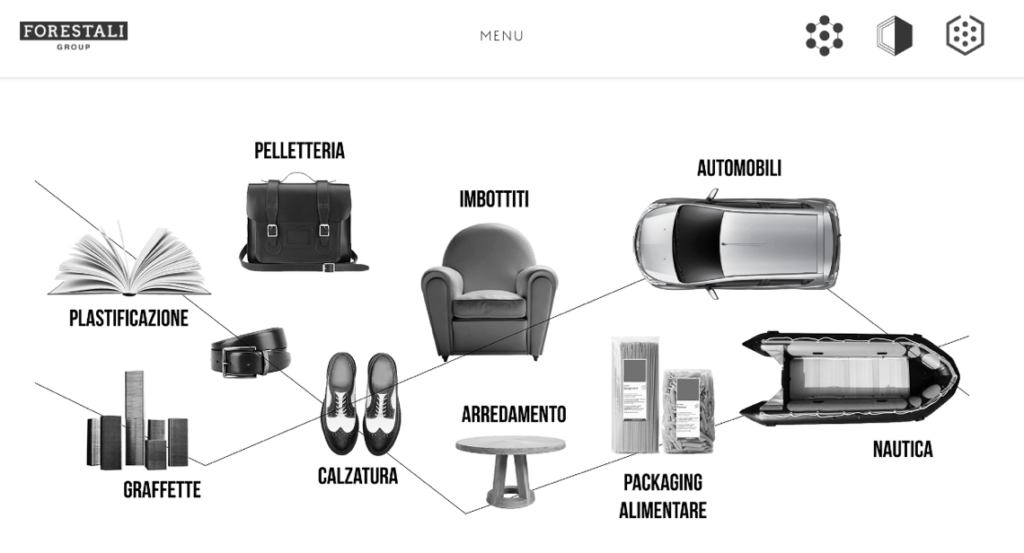

Italian leader producer of glues and adhesive fabrics for shoes and leather goods, for the automotive and flexible packaging sectors, Industrie Chimiche Forestali spa, will list at the Italian Stock Exchange thanks to a business combination with the Special purpose acquisition company (Spac) EPS Equita PEP SPAC spa.

Italian leader producer of glues and adhesive fabrics for shoes and leather goods, for the automotive and flexible packaging sectors, Industrie Chimiche Forestali spa, will list at the Italian Stock Exchange thanks to a business combination with the Special purpose acquisition company (Spac) EPS Equita PEP SPAC spa.

The deal has been voted last Friday Jan 19th by EPS Board of Directors and EPS’s meeting will be held in order to vote on the proposed integration next Feb 26th. EPS was advised by BonelliErede law firm and by financial advisor EY. Mediobanca acted as the Nominated Adviser (see here the press release).

As the deal wont’ ask the deployment of all the 150 million euros raised by EPS Equita PEP last July (see here a previous post by BeBeez), the Spac will be split into two veichles and an EPS Equita PEP SPAc2 will be listed on the Aim Italia market shortly.

EPS Equita PEP is the Spac promoted by Equita Group, Private Equity Partners spa (Pep), Fabio Sattin (PEP’s chairman), Giovanni Campolo (PEP’s ceo), Stefano Lustig (head of Equita’s Alternative asset management division) and Rossano Rufini (head of private equity at Equita sim), together in the investment veichle Equita PEP Holding srl.

ICF is now controlled by Progressio sgr and Mandarin Capital Partners with Private Equity Partners sgr and the management owning minority stakes. Mandarin and Private Equity Partners financed ICF’s management buyout in June 2014, while Progressio joined the two funds two years ago (see here a previous post by BeBeez). So today mandarin (though Cantarellus sa) owns a 51% stake and Progressio sgr a 39.28% stake, while both PEP and ICF’s ceo Guido Cami own a 4.17% stake each.

Founded in Maccagno (Varese) in 1918, the group is now headquartered in Marcallo con Casone (Milan) and counts 120 employees. The operative company reached 70.7 million euros in revenues in 2016, with 10.7 millions in ebitda and a net financial debt of 9.4 millions (see here an analysis by Leanus, after free registration and login). ICF reached 72.9 million euros in revenues in 11 months in 2017 with about 9 million euros in ebitda, 4.4 millions in net profit and 15.3 million euros in net financial debt.

As described in the Documento Informativo, the deal will follow the following steps:

- partial and proportional splitting of EPS Equita PEP SPAC spa in favour of EPS Equita PEP SPAC2 spa, which will be listed at the Aim Italia market after having received from EPS Equita PEP capital that won’t be necessary to buy ICF and pay EPS’s shareholders that eventually will recede from the deal (at the price of 10 euros per share, for a maximum equal to 30% of EPS ordinary shares minus one share);

- acquisition of 100% of ICF capital from actual shareholders for a price of 69.075 million euros on the basis of an enterprise value equial to 6.7x adjusted 2016 ebitda;

- acquisition of a minority stake in ICF by other 11 ECF’s managers and the reinvestment in ECF by Mr. Cami and PEP so that all together the 11 managers, PEP and Mr. Cami might own a maximum of 6.8% of ICF ordinary capital;

- acquisition of EPS’s special shares by the ICF’s manager who decide to invest in ECF too for a maximum of 20% of EPS’s special shares after splitting.