Cerberus Capital Management approached troubled Italian airline company Alitalia with an informal bid about taking control of all Alitalia’s assets but it did the move out of the official competitive auction set up by the Italian Government as the aution conditions were too severe, the fund thinks. The news was published by the Financial Times yesterday. Cerberus is ready to pay 100-400 million euros for taking control of Alitalia and the fund might ask the Italian Government to mantain a stake in the deal and to Italian trade unions to be involved in a profit sharing program, the FT added.

Cerberus Capital Management approached troubled Italian airline company Alitalia with an informal bid about taking control of all Alitalia’s assets but it did the move out of the official competitive auction set up by the Italian Government as the aution conditions were too severe, the fund thinks. The news was published by the Financial Times yesterday. Cerberus is ready to pay 100-400 million euros for taking control of Alitalia and the fund might ask the Italian Government to mantain a stake in the deal and to Italian trade unions to be involved in a profit sharing program, the FT added.

German airline company Lufthansa and low cost airline company easyJet are said to be among the seven bidders that had delivered their binding offers by last October 16th deadline. Both Lufthansa and easyJetsaid that they are interested in buying just some specific assets of Alitalia. When last September nine bidders were admitted to the dataroom (see here a previous post by BeBeez), six of them were said to be interested just in the aviation business while the other three were bidding for the handling business.

The nine names were then Ryanair (before the company started to cancel tons of flights), EasyJet, Lufthansa, US hedge fund Elliott and private equity firms Cerberus Capital and Greybull Capital, Airport handling, Airport service and Alisud.

It is not clear however how Cerberus can bypass EU regulations that compell extra-EU subjects to buy more than 49% of an airline shareholders capital, MF Milano Finanza writes today. As this is not possible, it seems to be necessary that the Italian Government and Alitalia workers will own a 51% stake. Moreover, Alitalia commissioners had published an addendum to the auction rules (see here the auction rules and the addendum to the auction rules) explaining that the only way to enter the auction for a bidder who did not delivered its formal bid in the auction framework is to enter in a consortium with a subject who had instead made a formal bid. This means that Cerberus should team up with easyJet or Lufthansa, but these two subjects have said they want just some specific assets and not Alitalia as a whole.

So the only option might be that the auction ends up with no deal so that Cerbersu might come up with its offer afterwords. However this mean to wait for next April 30th which is the deadline for presenting better offers.

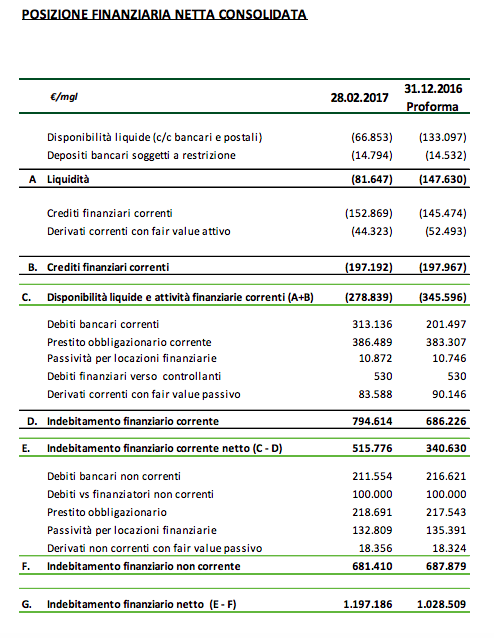

At the end of February 2017 Alitalia was burdened by 1.2 billion euros of net financial debt or 200 million euros more than on December 31st 2016 (see here the Financial Statement prepared for the auction).

Since cllapsing into extraordinary administration last May, Alitalia is managed by three Government-appointed commissioners Luigi Gubitosi, Enrico Laghi e Stefano Paleari. The Italian Government has agreed to extend to 900 million euros a bridge loan in order to guarantee flights till next September 2018.