Transactions on Italian bad loans portfolios were 160 in 2016 (of which 119 already finalized) for a 23.9 billion euros total gross book value, in slightly growth from 2015, Credit Village’s National Npl Observatory says, adding that the figur includes all transactions that have been actually made on the Italian market and not just publicly announced. About half of the value (11.3 billion euros) is relative to eals happened on the secondary market, while the primary market swa Npls sales for 12.6 billion euros.

Transactions on Italian bad loans portfolios were 160 in 2016 (of which 119 already finalized) for a 23.9 billion euros total gross book value, in slightly growth from 2015, Credit Village’s National Npl Observatory says, adding that the figur includes all transactions that have been actually made on the Italian market and not just publicly announced. About half of the value (11.3 billion euros) is relative to eals happened on the secondary market, while the primary market swa Npls sales for 12.6 billion euros.

As for Credit Village, major sellers on the Italian primary market were banks (75% of the total transactions value), followed by consumer finance institutions and financial divisions of automotive companies (16%) and by utility and tlc companies (9%). Deal structure saw a majority of deals made through securitization SPVs (61 deal out of 119), while other deals have been made directly by financial intermediaries or banks and a limited numer was made by debt recovery companies.

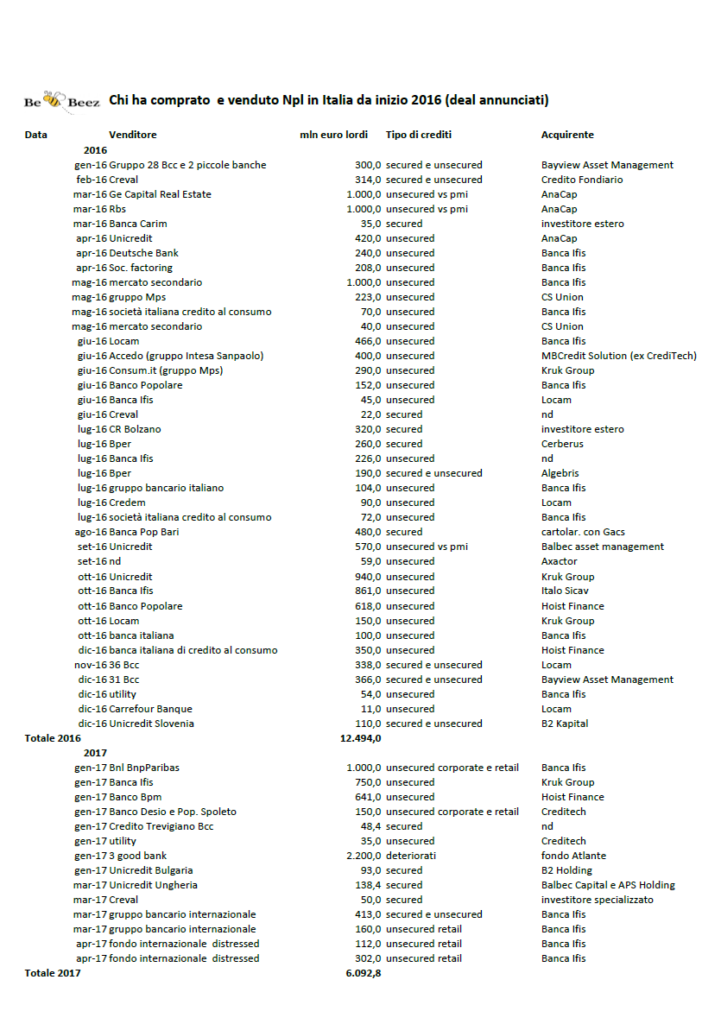

Italian Npl market is still rathar opaque. PwC actually calculates that Npl transactions have been 38 in 2016 for a total gross value of 13.8 billion euros, while BeBeez’s database includes 39 deal for a 12.5 billion euros total gross value in 2016 and 14 deals since the beginning of 2017 for a 6.1 billion euros total gross value (download here a pdf file with the list of the deals).