Banca Ifis bought non-performing loans portfolios for 3.1 billion euros gross value and paid 195.6 millions, made by 463,566 positions. The bank sold Npls portfolios cashing 73 million euros in and generating 44.5 million euros in profits. Figures are shown in Banca Ifis consolidated financial statements for FY 2016 which were published yesterday.

Banca Ifis bought non-performing loans portfolios for 3.1 billion euros gross value and paid 195.6 millions, made by 463,566 positions. The bank sold Npls portfolios cashing 73 million euros in and generating 44.5 million euros in profits. Figures are shown in Banca Ifis consolidated financial statements for FY 2016 which were published yesterday.

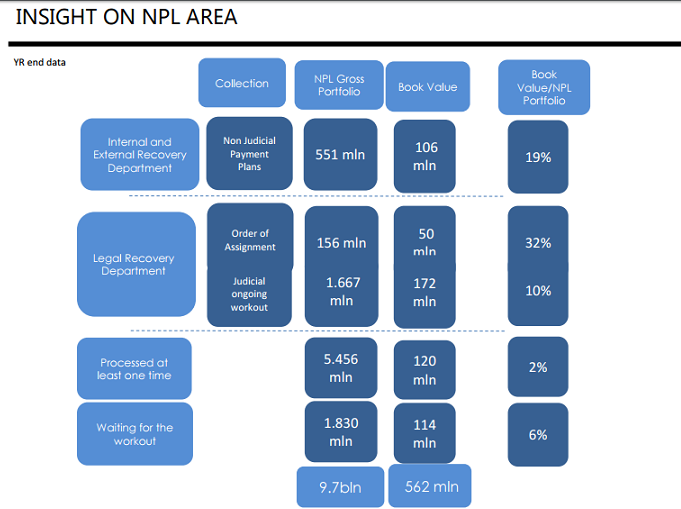

At the end of 2016 then the bank managed by ceo Giovanni Bossi and listed on the Italian Stock Exchange held 9.7 billion euros of groos book value in Npls or 562 millions in net book value (see here Banca Ifis’s analysts presentation).

Banca Ifis’s Npl division contributed to the banks’ intermediation margin for as much as 187.4 million euros in 2016 (from 56.3 millions in 2015) out of a total intermediation margin for the bank of 358.6 millions (from 408 millions).

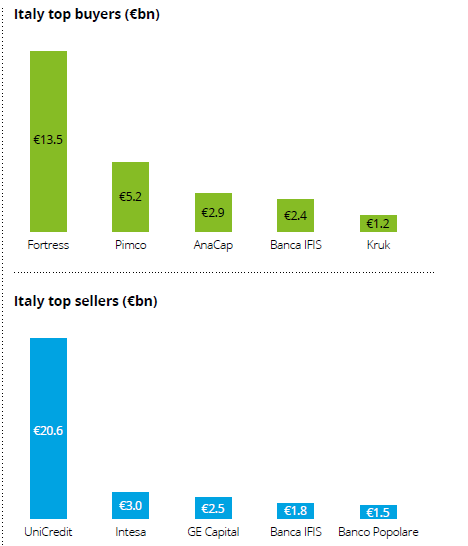

Actually in its last report Deleveraging Europe, Deloitte estimated Banca Ifis to have bought about 2.4 billion euros in loans in 2016, positioning the bank among the major buyers of performing and non-performing loans in Italy, after Fortress (13.5 billions). Pimco (5,2 billions), Anacap (2.9 billions) and KrukGroup (1.2 billions).