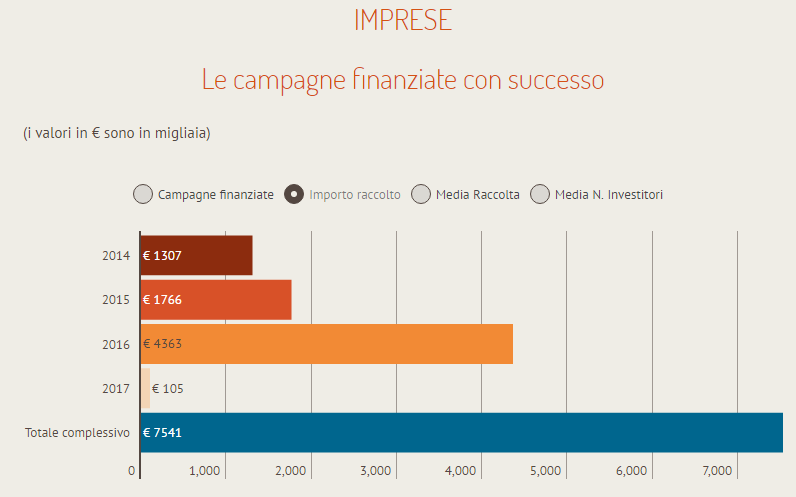

Equity crowdfunding is growing up in Italy at a fast pace even if numbers are still tiny. Last year Aiec, lthe Italian Association of Equity Crowdfunding Platforms, calculated that 19 campaigns were succesful and raised a total of 4.4 million euros, which is quite a result in comparrison to the 7 succesful campaigns of 2015 which had raised just 1.7 millions. Moreover the trend has been more evident in the last few months: in sole Q4 2016 8 campaigns were closed with success.

Data were elaborated in collaboration with specialist Italian site Crowdfundingbuzz (which is owned by EdiBeez srl,as well as BeBeez) and show that the average round size in 2016 was 230k euros in line with 250k in 2015, with 39 investors per round on average (from 37 in 2015). Investors have been a total of 800, that is tìmore than three times the 260 investors counted in 2015. Each investment wa5,800 euro on average in 2016 from 6,800 euros in 2015.

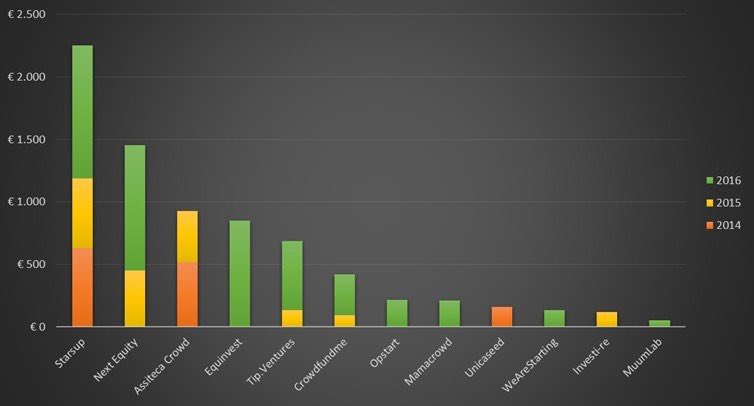

The richest campaign has been the one by Synbiotec srl, an innovative small company focus on research, development and production of high quality probiotic products, which has raised one million euros on NextEquity platform (see there a previous post by BeBeez), but the platform that has raised the most in 2016 was Starsup, followed by NextEquity and Equinvest.

On a 3-years basis Starsup is still on the top of the list with 2.25 million euros raised and succesful campaigns, followed by NextEquity (1.45 millions and 2 campaigns) and by AssitecaCrowd (0.93 millions and 2 campaigns).