Management & Capitali (M&C), an investment company listed at the italian Stock Exchange and controlled by financier Carlo De Benedetti (with a 53% stake through Sper spa), is buyng Treofan Holdings GmbH from minorities shareholders Merced Capital and Goldman Sachs.

Management & Capitali (M&C), an investment company listed at the italian Stock Exchange and controlled by financier Carlo De Benedetti (with a 53% stake through Sper spa), is buyng Treofan Holdings GmbH from minorities shareholders Merced Capital and Goldman Sachs.

Leonardo & Co-Houlihan Lokey had been appointed as mandated advisor for the sale of the whole capital of Treofan last Spring (see here a previous post by BeBeez) and last July some expressions of interest came from industrial groups and private equity firms.

The three actual shareholders took control of Treofan in 2009 (M&C owns a 41.6% stake) in a debt to equity swap of about 170 million euros of high yield bonds.

M&C ‘s decision to invest even further in Treofan was based on the very positive performance of the past two years, with a normalised gross operating profit of 29.5 million euros in the first eight months of 2016, up 30 percent on the same period in 2015 (22.7 millions). M&C is expecting a further increase in profitability in the future (see here Treofan’s press release and M&C’s).

The acquisition will require an outlay in the range of 45 million euros (given that 100% of Treofan is valued at just above 80 millions).

M&C’s Interim Financial Report says that Treofan’s consolidated ebitda rose to 24 million in the six months at June 30th 2016 (from 18.6 million an year before) with an 11% ebitda margin (from 8.6%). Bet profit reached 3.9 millions (from 1.9 millions) even if revenues were a bit lower at 218.5 millions (from 219.1 millions). In the meantime, net financial debt dropped to 54 million euros (fronm 56 million on December 31st 2015), net of a 35 million euros shareholders’ loan.

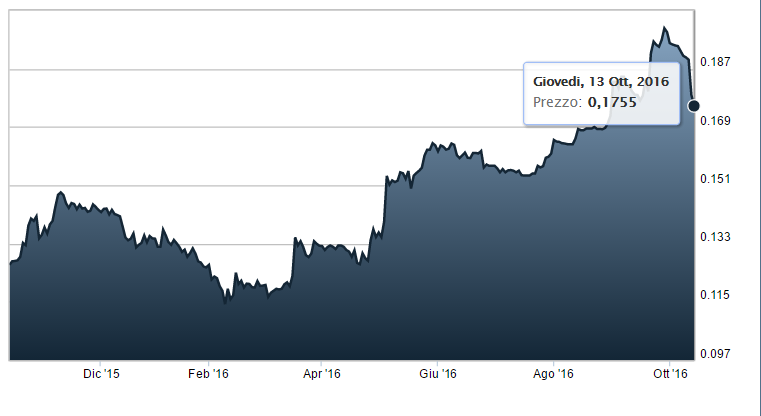

M&C closed at 0.1755 euro per share at the Milan Stock Exchange yesterday (-1.9%) with a 81.65 million euros market capitalization.