Year 2015 was quite an intensive period as for venture capitalists and business angels in Italy, BeBeez‘s database shows (download here a table with data an links to BeBeez’s posts).

Year 2015 was quite an intensive period as for venture capitalists and business angels in Italy, BeBeez‘s database shows (download here a table with data an links to BeBeez’s posts).

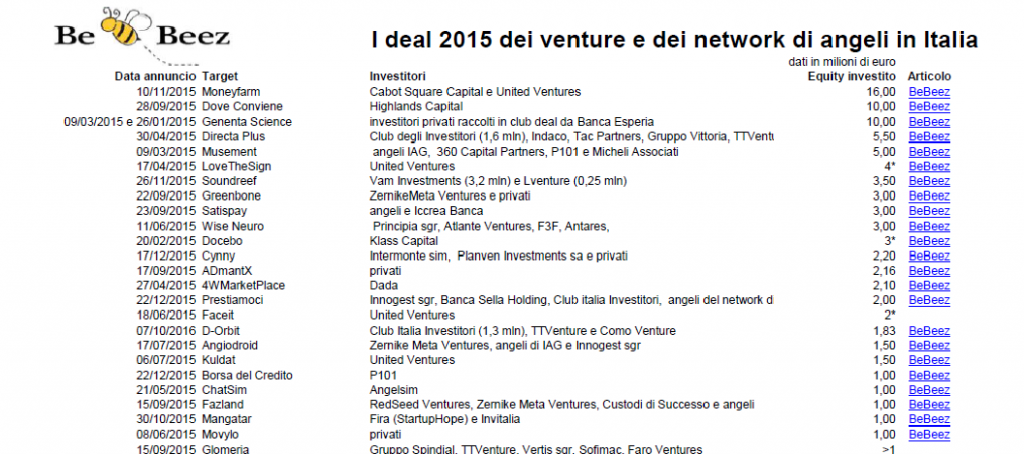

More in detail BeBeez counted 86 deals as for new investments and capital increases last year for a total amount of about 104 million euros (but this is a lower figure than what actually was invested in those deals as value for some of them was not disclosed). Moreover some deals have not been communicated.

Among the biggest deals it’s fair to remember the following: the online trading advisory company MoneyFarm (a 16 million euros round from Cabot Square and United Venture), the biotech company Genenta Science (a 10 million euros round from private investors gathered in a club deal by Banca Esperia) and the online shops promotions platform DoveConviene (a 10 million euros round from Highland Capital Partners Europe).

However due to the limited size of Italian startups also 1 to 5 million rounds are to be looked as quite significant investments by venture capitalists and business angels in Italy. Here are some examples: the online booking services platform for travel activities Musement (5 millions from private investors part of the Italian Angels for Growth network, from 360 Capital Partners and P101 funds, and from Micheli Associati); Lovethesign, an online “Italian style” design furniture e-commerce platform (4 million dollar from United Ventures); music royalties management company Soundreef (3.5 million euros from Vam Investments and LVenture Group); biotech company Wise Neuro (3 millions fromPrincipia sgr, Atlante Ventures, F3F, Antares, High-Tech Gründerfonds, Atlante Seed and b-to-v Partners); Satispay, a company which devolped a smartphone app for mobile payments (3 millions euros from new and old investors, with Google Wallet founders, Jonathan Weiner and Ray Iglesias, and Google Wallet international division head, Jon Koplin, among them); D-Orbit, a company specialized in the recovery of space debris i (1.83 million euros from Club degli Investitori, TTVenture and Como Venture); Drexcode, an online fashion dresses renting site (1,5 million euros in two different funding rounds from LVenture, Innogest, LigurCapital and private investors members of the Italian Angels for Growth network); biotech company Angiodroid (1.5 million euros from ZernikeMeta Ventures, private investors members of the Italian Angels for Growth and Innogest fund).

It happend sometimes that italian startups have been totally or partially bought by industrial companies both Italian and international. This is the case of HelloFood (ex Pizzabo), a food delivery platform which has been bought by German e-commerce giant Rocket Internet for a 55 million euros price tag; as well as the case of Cliccaemangia e Deliverex, both food delivery platforms too which have been bought by the British food delivery giant Just Eat; as it was the case of MyTable and Restopolis, both online restuarants booking platforms that have been acquired by TripAdvisor.

Other examples are: Fatture inCloud, a company specialized in electronic Invoicing services whose majority stake has been acquired by Italy’s business information software system leader Teamsystem; SpazioDati, a startup company active in analyis and management of big data which attracted 1.35 million euros fof a minority stake from the Italian leading credit information company Cerved Group; 4WMarketPlace, the Italian leading online adnetwork italiano, gained a 25% capital increase by Italy’s Dada (Orascom group); Dotadv, the fist automatic online adv management platform for SMEs, which has been bought by Subito.it, a leading used goods e-commerce platform; Wikire, an online platform for real estate agents that obtained an investment by the international real estate network Re/Max; biotech company VivaBiocell which has been bought by US NantWorks LLC; Map2App, which developed an online platform able to build apps which in turn create touristic guides, that has been bought by Bravofly Rumbo Group; VisLab srl (Vision e intelligent systems laboratory), a spinoff from Parma University which developed computer vision and intelligent control systems for automotive and other commercial applications and was bought for 30 million dollars by Ambarella, a US leading developer of low-power, high-definition (HD) and Ultra HD video compression and image processing solutions.

Finally year 2015 saw three venture-backed ipos too, one of which in the US and the others in Italy. As for the latter two, last February Banzai was listed on the Star segment of Borsa Italiana. This is a leading Italian e-commerce operator and one of the most important digital publishers in the portfolio of Sator fund: Banzai raised 54 million euros from the ipo and started trading with a 274 million euros market capitalization. Last November venture incubator H-Farm, which was launched someyears ago by the founders with the help of institutional investors, was listed on Aim italia raising 20.5 million euros in ipo and started trading with 89 million euros of market cap. Again last November Advanced Accelerator Applications (AAA) was instead listed on the Nasdaq. The company is an international specialist in Molecular Nuclear Medicine headquartered in France and partecipated by Italian investment company Life Sciences Capital spa. AAA raised 75 million dollars in ipo and started tranding with 617 million dollars of market cap (now it is over one billion dollars).